Real Time Platinum Prices at Minot Coin

Stay informed about the latest platinum spot prices with our real-time price charts provided below. Easily access live spot price charts and customize date ranges to track historical price movements over the years. Our spot price charts are designed to empower investors by enabling them to monitor market trends and refine their investment strategies. Take advantage of our top sellers in platinum to make the most of the live spot prices!

Understanding Platinum Spot Pricing

Keep pace with the ever-changing landscape of platinum spot pricing, reflecting the current market rate for an ounce of platinum available for immediate delivery. This live benchmark experiences minute-by-minute shifts driven by a multitude of factors, including:

- Global mining supply dynamics

- Industrial and jewelry manufacturing demands

- Fluctuations in the strength of the US dollar

- Geopolitical tensions in key producing regions

While denominated in dollars per troy ounce, the universal spot price governs the cost of platinum transactions, be they significant or modest, in real-time. At Minot Coin and Bullion, our approach to platinum product pricing incorporates nominal premiums to cover production, shipping, and operational costs, ensuring alignment with the fluctuating daily spot rate.

Navigating the daily performance of platinum may present a challenge to newcomers. However, our seasoned analysts navigate these fluctuations, empowering you to seize opportunities in the market. If you have any questions, the Minot Coin and Bullion team is here to assist you.

Understanding Platinum Valuation

The daily spot price is influenced by an array of variables, including global mining output, industrial consumption patterns, currency dynamics, and geopolitical developments. Our dedicated team meticulously tracks these factors to provide insights into market trends.

Shifts in platinum prices are shaped by diverse factors, such as fluctuations in automobile manufacturing demand and shifts in investor sentiment in response to global uncertainties. Understanding these dynamics is essential to navigating the platinum market effectively.

Contact us to discuss the latest platinum price moves or sign up for market alerts through our newsletter. We assist investors at any knowledge level.

The value of platinum products is determined by various factors, including purity, weight, and additional considerations such as rarity and aesthetic appeal. These elements collectively contribute to the premium value above the raw melt price.

Platinum Purity Guide

Platinum maintains its beauty and is treasured for its white luster. Know its common purity grades when buying platinum items:

950 PLATINUM

The highest grade is composed of 95% pure platinum content. Most platinum bullion coins and bars will be this grade.

900 PLATINUM

Contains 90% pure platinum. More alloy content makes this grade more durable for jewelry.

850 PLATINUM

The lowest platinum purity is 85% platinum. Least expensive grade but still offers a bright white appearance.

Unlike gold, platinum purity is measured in 1,000 parts instead of karats. But similar to gold, platinum is alloyed with metals like copper for improved hardness. Its natural white radiance and resistance to tarnishing makes platinum a top precious metal.

By understanding differences between platinum grades, you can make informed purchases from reputable platinum dealers like Minot Coin & Bullion. Contact us with any questions!

What is Platinum Bullion?

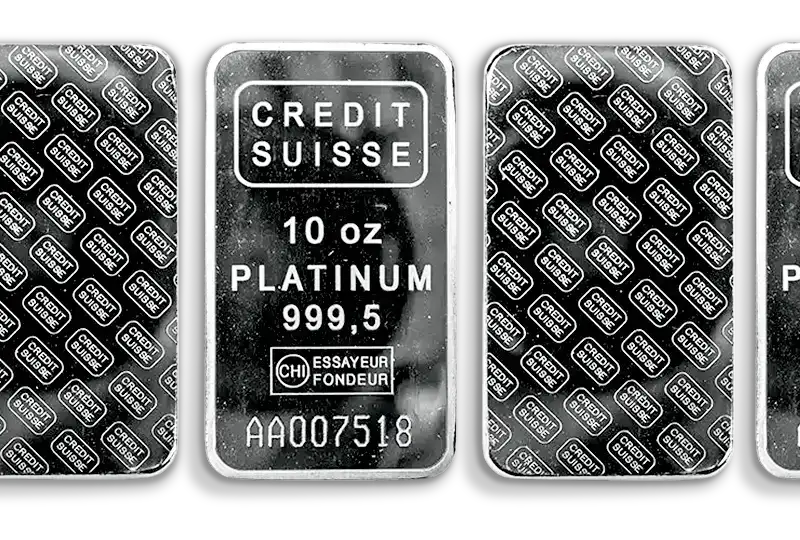

Platinum bullion denotes pure platinum, verified to be at least 99.95% pure precious metal. This esteemed asset is typically held in the form of bars, ingots, or coins, primarily sought after for investment purposes.

Key attributes of Platinum Bullion

High purity standards

Must be .9995 pure platinum to qualify as bullion. This ensures its inherent and resale value.

Platinum Bars and Ingots

Mass produced by refiners and mints in various sizes from 1 gram up to 100 oz. Allow convenient storage and transport.

Platinum Bullion Coins

Special platinum coins struck by government mints in set weights like 1/10 oz and 1 oz, with a legal tender face value.

Platinum Pricing

Trades at prevailing platinum spot prices plus a small premium from the manufacturer.

Platinum bullion offers a unique opportunity for portfolio diversification due to its rarity, exceeding that of gold or silver. Acting as a hedge against inflation and market volatility over extended periods, it provides investors with a valuable safeguard for their wealth

Get Our Latest on YouTube.

Stay updated with our newest precious metal arrivals, deals, and announcements by following the Minot Coin YouTube channel! Subscribers are first to know about inventory updates like fresh wholesale and retail bullion and coin arrivals. For exclusive access, hit the “Subscribe” button below.